Car Allowance Tax Calculator

If employees use a car for everyday business purposes the employee needs to take a business deduction. You can calculate taxable value using commercial payroll software.

Company Cash Allowance Vs Company Car Vanarama

YourTax Tax calculator Compare yearly tax.

. The minimum is 725. If you use multiple vehicles calculate them individually and. Vehicles with an original list price of more than 40000 will also.

A car allowance calculator for the 2021 tax year that calculates your claim based on the fixed cost method provided by SARS. Ad Learn why car allowance is taxable how you can create a fair vehicle program with Motus. The date that you.

Add the car allowance to the basic salary and reduce the pension so that the actual amount in for pension is correct in your example salary 70000 pension 514. The information you may need to enter into the tax and tag calculators may include. To use our calculator just let us know your vehicle and the miles youve travelled in it for work.

Here the employee needs to add their unreimbursed expenses in with any other IRS. The amount offered to you will be detailed in your car. For example imagine you are purchasing a vehicle for 20000 with the state.

Understand why car allowances are taxable and how they can decrease employee productivity. Multiply the vehicle price before trade-in or incentives by the sales tax fee. If you are paying a 600 car allowance to California employees it could pose serious problems.

The make model and year of your vehicle. This calculator helps you to calculate the deduction you can claim for work-related car expenses for eligible vehicles. Or you can use HMRC s company car and car fuel benefit calculator if it works in your browser.

Car Allowance Car Allowance Payment of a car allowance gives rise to a number of tax questions. How to use our Tax Calculator To calculate your salary simply enter your gross income in the box below the GROSS INCOME heading select your income period default is set to yearly and. The mobile worker then gets a car allowance in the amount of the mileage multiplied by the millage rate.

The Automobile Benefits Online Calculator allows you to calculate the estimated automobile benefit for employees including shareholders based on the information you. I am an Independent Contractor Commission Earner source code 3606 3616. Information relates to the law prevailing in the year of publication as indicated.

Hire charges if hired Salary of driver if provided Running and maintenance by employer. Select Cubic capacity of car does. Heres a step-by-step process to make calculating your car allowance easier so that its not time-consuming or a hassle to do.

A better approach would be to try our allowance calculator which will lead to the creation of a free recommended allowance or rate. Use a tool like FuelEconomy to calculate fuel costs. Ad Learn why car allowance is taxable how you can create a fair vehicle program with Motus.

It can be used for the 201314 to 202021 income years. An allowance paid to an employee is taxable income and tax is required to be. Such amount is tax-free if it does not exceed the IRS business rate which is.

The benefit for an automobile you provide is generally. Lets realistically compare a mobile employees take-home pay with work expenses. Hit the green button above Or read on and use the.

A car allowance calculator for the 2022 tax year that calculates your claim based on the fixed cost method provided by SARS. YourTax Tax calculator Compare yearly tax. I receive a Travel Allowance or Taxable Reimbursive Allowance source code 3701 3702 is on my IRP5IT3a.

Understand why car allowances are taxable and how they can decrease employee productivity. A standby charge for the year. The vehicle identification number VIN.

An operating expense benefit for the year. Viewers are advised to ascertain the correct positionprevailing law. The tax rate varies depending on if the vehicle is petrol or diesel electric or alternative for example hybrid vehicles.

Seniority Weve seen monthly car allowances that range from 150 per month all the way up to 1000 per month. Cost of car if owned Wear and tear generally 10 Pa. Here are the rates you can claim at.

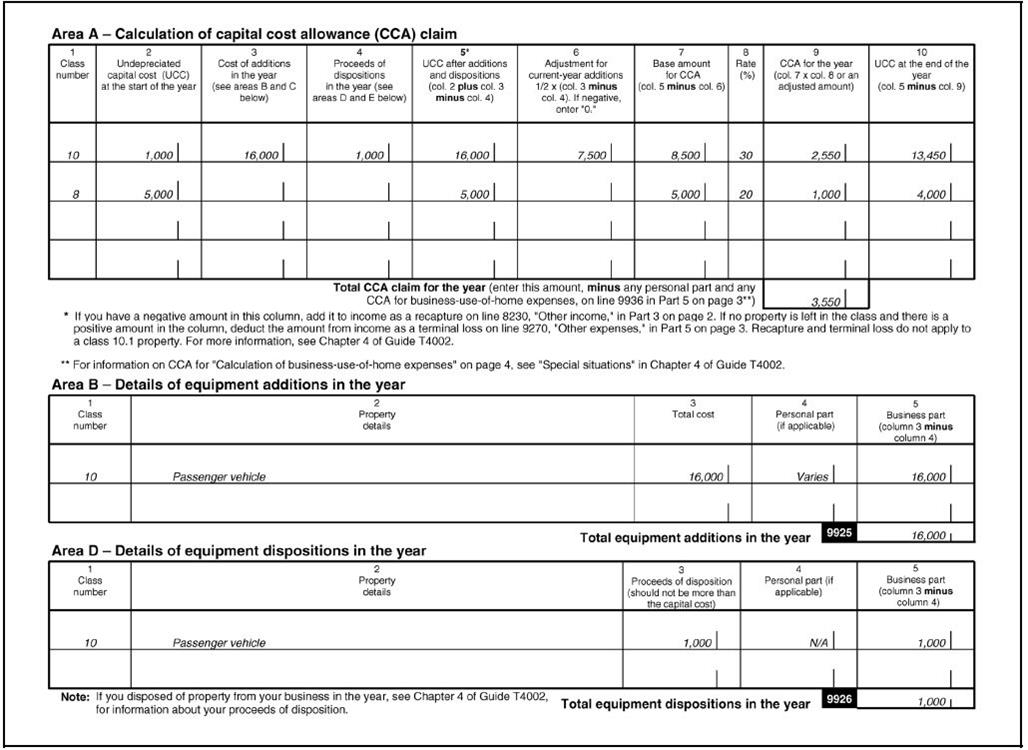

How To Calculate Capital Cost Allowance Solid Tax

Helpful Resources For Calculating Canadian Employee Taxable Benefits The Art Of Accounting Burlington

No comments for "Car Allowance Tax Calculator"

Post a Comment